Today, 95 percent of global internet users use a smartphone to go online. The most captive mobile audiences come from mobile-first countries, such as Singapore, South Korea and Japan, where people spend roughly 5 hours daily on mobile apps. Given the amount of consumer attention, it’s no surprise that mobile advertising is a critical element within the APAC marketing playbook. However, some aspects of mobile advertising are still not as well understood as others.

Within the mobile environment, gaming has arisen as a new form of mass entertainment among generations both young and old. In 2022, consumers across the globe spent $110 billion on mobile apps, which is more than 4 times higher than the global cinema box office. In Japan alone, the revenue from mobile games in 2022 was 8 times higher than the domestic cinema box office.

Across APAC, 87 percent of digital ad spending goes into mobile channels. But how reflective is that spending when it comes to the reality of mobile gaming? To find out, PubMatic commissioned a study from Milieu Insight that asked brands and agencies in Singapore, Japan and South Korea about their mobile and in-game ad buying preferences, challenges and plans for next year. Here’s what we learned.

Brands Are Seeing In-App Ad Investments Pay Off

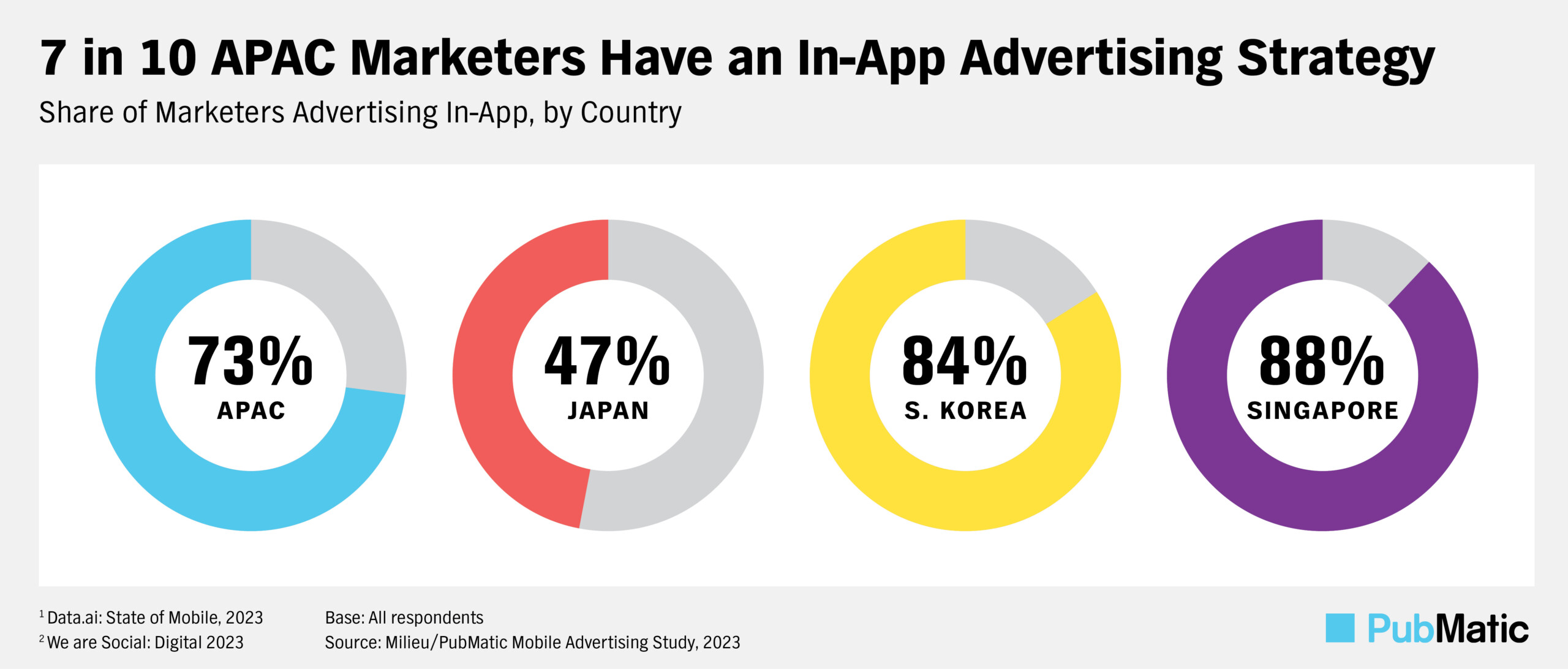

Our study found that 7 in 10 marketers in APAC currently incorporate in-app ads into their marketing strategy. At 88 percent, Singaporean buyers are most likely to buy in-app, while Japanese buyers are doing far less in-app buying at 47 percent. Across countries, performance-focused buyers are more likely to advertise in-app than brand buyers, at 77 percent and 60 percent, respectively. Despite this discrepancy, APAC marketers say that brand awareness is the leading benefit of in-app advertising, regardless of their primary advertising objectives.

Barriers Remain Between Advertisers and Mobile Games

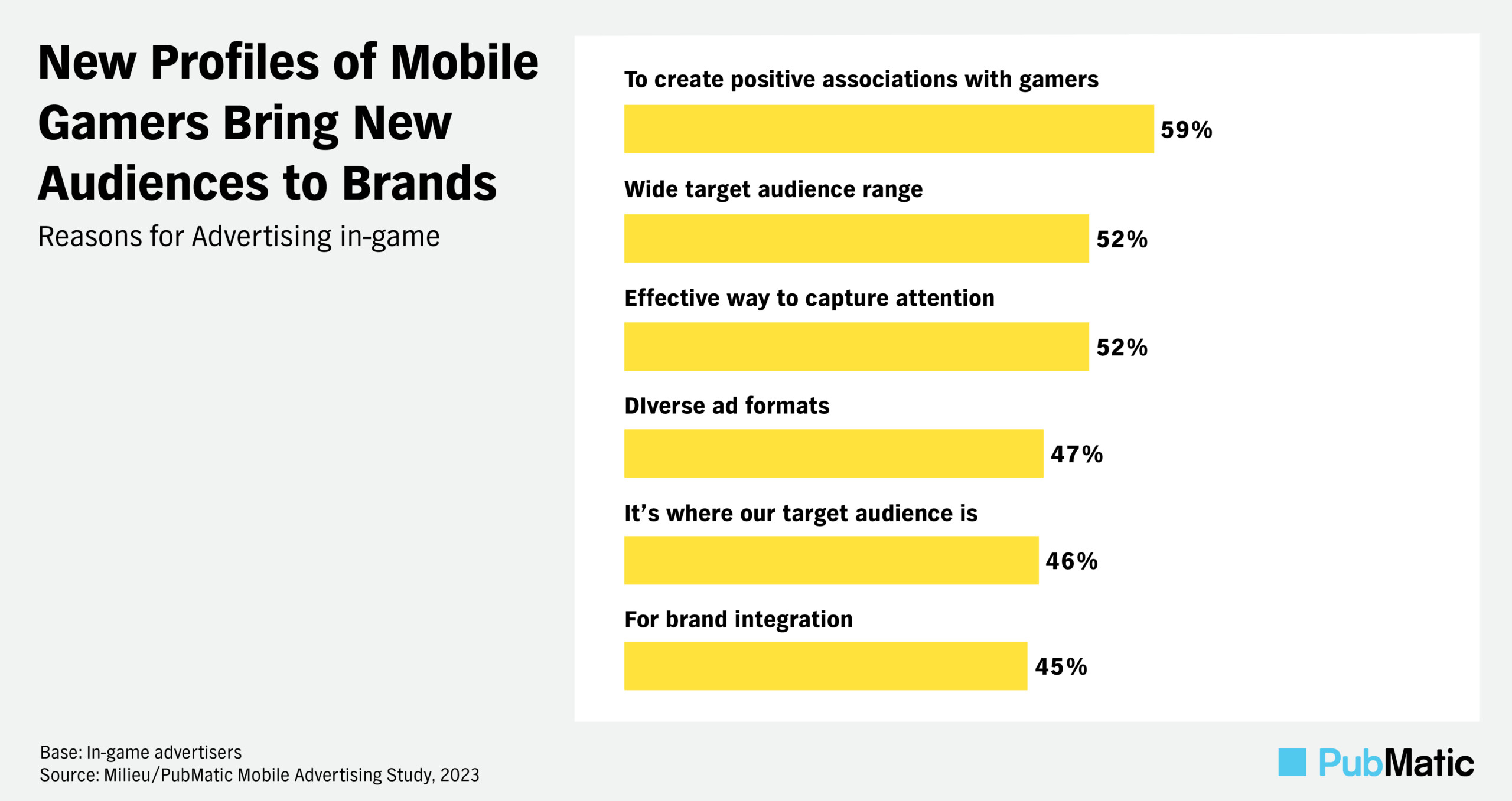

When we narrowed the aperture of our survey to mobile games, we found that only 52 percent of all marketers have an in-game marketing strategy, with a wide variance of adoption across APAC countries; only 15 percent of Japanese marketers are spending on in-game ads, versus 77 percent of marketers in Singapore. Most advertisers who are reluctant to invest in mobile gaming ads cited their reason as misalignment with company or brand values, or misalignment in target audiences.

Misconceptions about mobile gamer audiences can result in missed opportunities to reach important demographics, including those with higher purchasing power. Marketers tend to believe that mobile gaming audiences are predominantly young males. However, third-party data shows that the average mobile gamer is as likely to be female as male, and older players actually spend more time engaged with mobile games than their younger counterparts. In Japan, where mobile marketers are most hesitant to invest, women account for 55 percent of the mobile-first gaming community.

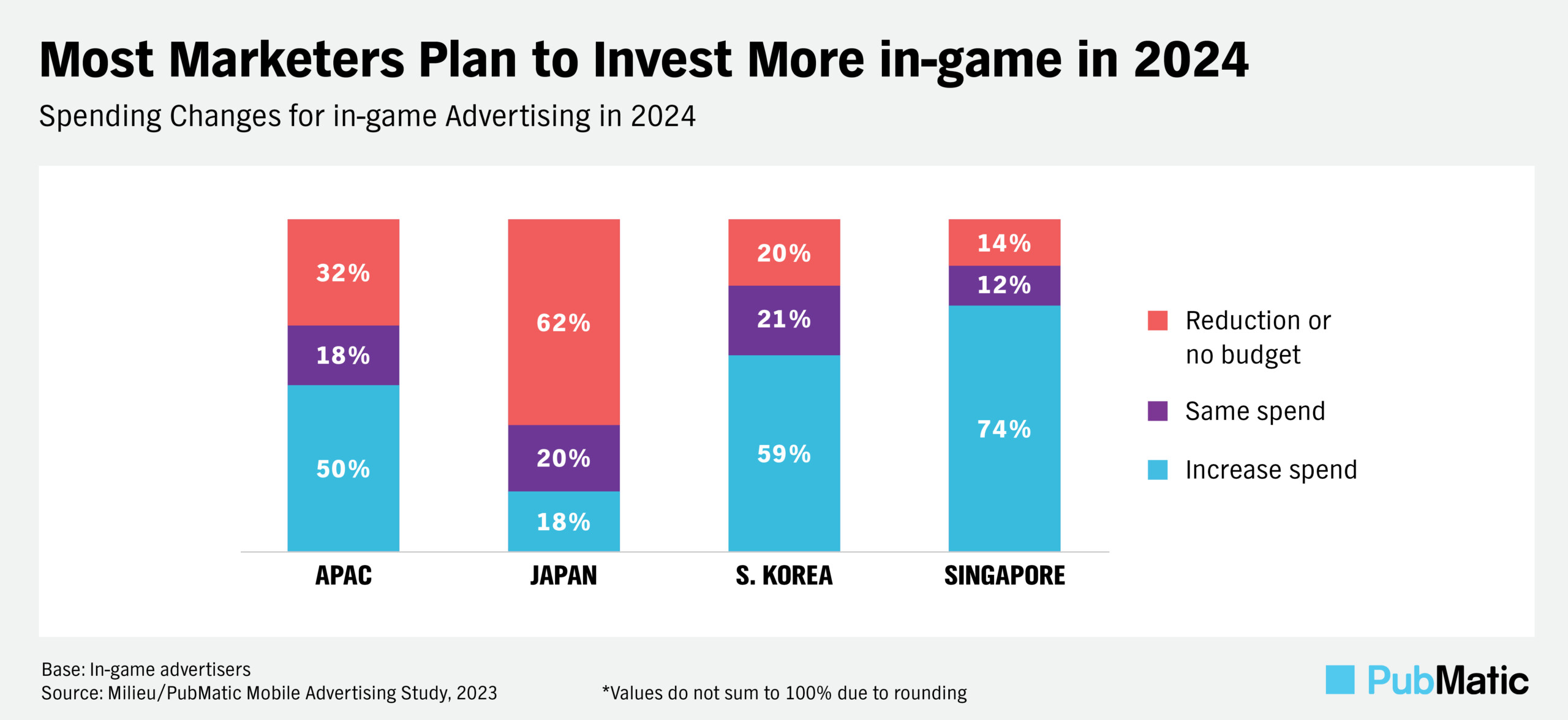

Given that 68 percent of in-game advertisers plan to increase or keep the same budget next year, it is critical for app developers and publishers to work with a technology partner that can strategically curate differentiated inventory by demographics, hobbies, interests and holidays to reach advertiser target audiences.

Control and Efficiency Are Critical to Mobile Advertisers

62 percent of in-app advertisers buy ads programmatically, while the remainder prefers to transact directly with publishers. Programmatic buyers cited “audience targeting precision” as the top reason for how they purchase, followed by “more control over ad placement” and “customizable solutions tailored to specific goals of our brand.”

In the supply chain, private marketplaces (PMPs) provide the benefits of both direct sales and programmatic. They allow publishers to know who is buying their inventory, while enabling advertisers to choose which inventory they want to spend on in a streamlined fashion. PMPs provide a secure environment with tight controls around transparency, brand safety, inventory quality and deal price. By working with a trusted partner, advertisers and publishers alike can achieve better outcomes via PMPs.

Here’s How to Level Up Your Game in 2024

In 2024, 86 percent of in-game advertisers in Singapore and 80 percent of those in South Korea plan increase or keep the same budget for in-game advertising. Only Japanese marketers are hesitant to go all-in on in-game advertising right now, due to the above-stated misperceptions of audience alignment. However, in today’s highly connected global economy, there are more chances than ever for publishers to attract ad spend from international buyers looking to invest in mobile games. Working with the right partner can help you capture dollars from diverse channels and geographies.

Download PubMatic’s latest report, Brand x Mobile Gaming: What the shift of brand spend into mobile gaming mean for publishers, to get more insights and tips for mobile app and gaming success.