As spend grows in connected TV (CTV) and over-the-top (OTT) advertising, so, too, do the tactics that allow advertisers to capitalize on these channels.

Content object signals are one of the latest tools publishers and advertisers can use to enhance contextual targeting.

These signals include content type, genre and rating, as well as whether the content is live. Genre in particular helps with both targeting and brand safety while rating also helps enhance brand safety by avoiding mature or children’s content.

When publishers include these signals in their bid requests, advertisers gain a much better understanding of the impressions they are bidding on.

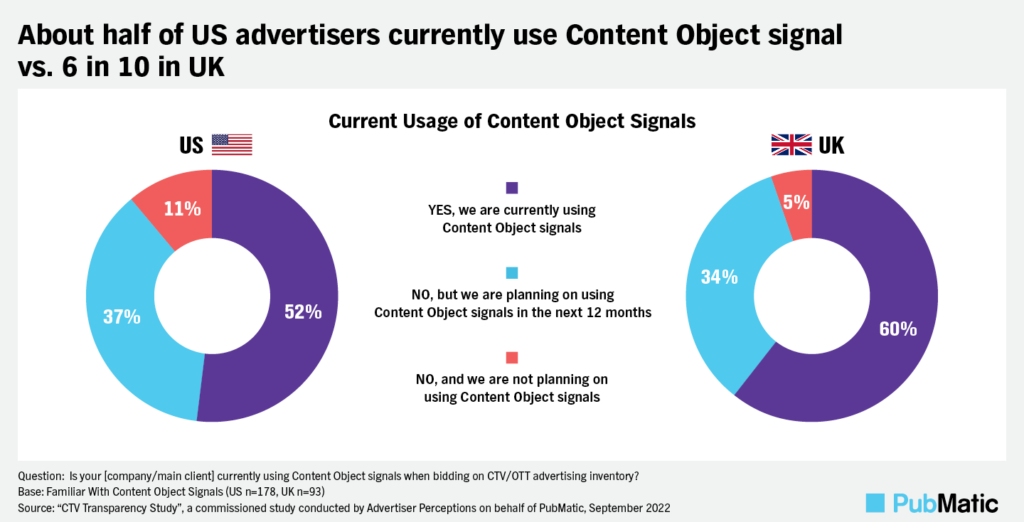

However, a recent study from PubMatic and Advertiser Perceptions found only about half of U.S. and U.K. advertisers are familiar with content object signals and use them to purchase CTV/OTT video ad inventory.

Circle chart with the title: “About half of US advertisers currently use Content Object signals vs. 6 in 10 in UK”. US circle chart on the left with 52% saying “YES, we are currently using Content Object signals”, 37% saying “NO, but we are planning on using Content Object signals in the next 12 months”, and 11% saying “NO, and we are not planning on using Content Object signals”. UK circle chart on the right with 60% saying “YES, we are currently using Content Object signals”, 34% saying “NO, but we are planning on using Content Object signals in the next 12 months”, and 5% saying “NO, and we are not planning on using Content Object signals”.

But buyers can use this transparency from content object signals for better attribution and optimization. That’s in part why the report also found U.S. and U.K. advertisers intend to increase spend with partners that provide these signals.

Here are three additional advantages to using content object signals:

Combined Video Ad Buys

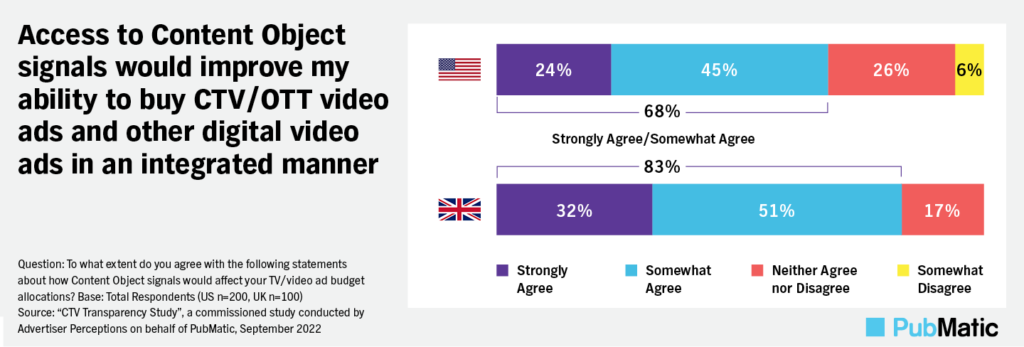

Content object signals also help advertisers make sense of CTV/OTT video ad buys that are combined with linear TV or digital video campaigns. That’s because they make CTV buying more like programmatic display buys, which include impression-level data, as well as linear TV buying, which uses content to target audiences. The result is more cohesive campaigns across channels that use both audience and context for targeting—and which are easier to understand together.

According to the report, a majority of advertisers in the U.S. and U.K. say access to content object signals improves their ability to make these combined video ad buys.

Bar chart with the title: “Access to Content Object signals would improve my ability to buy CTV/OTT video ads and other digital video ads in an integrated manner”. For the top bar chart, the US flag is on the left, with 24% being strongly agree, 45% is Somewhat agree, 26% being Neither agree nor disagree, and 6% somewhat disagree. 68% strongly agree/somewhat agree in this chart. On the bottom, UK bar chart has 32% people who strongly agree, 51% somewhat agree, and 17% Neither agree nor disagree. With 83% Strongly agree/ Somewhat agree.

More Inventory

The additional targeting parameters that come with content object signals also means additional inventory opportunities from supply sources advertisers were not previously working with.

This should help solve a long-running problem in which ad buyers struggled to find the CTV/OTT inventory they wanted and therefore relied on direct deals with publishers or private programmatic deals. This was a time-consuming process that also limited the number of partners a given advertiser could work with—and lacked benefits like cross-platform frequency capping and real-time optimization.

Further Growth

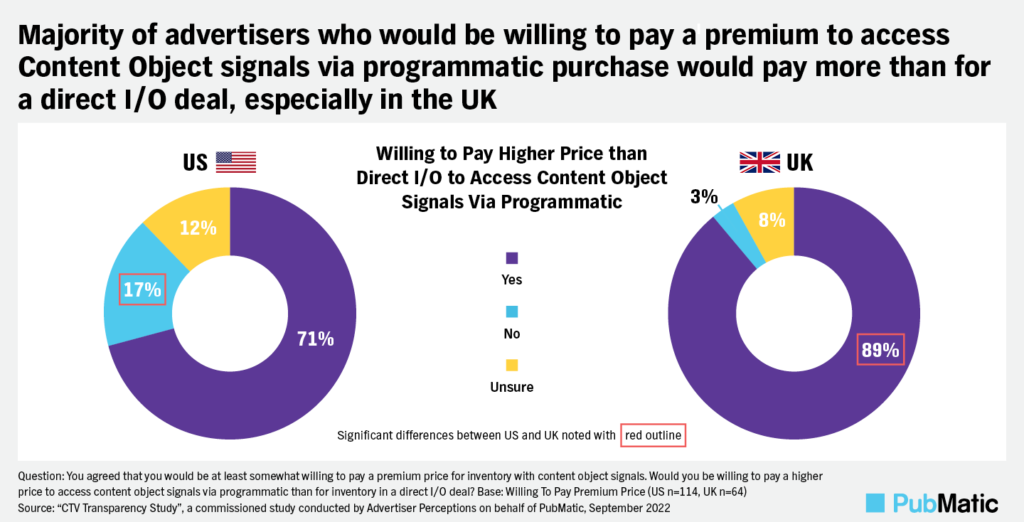

What’s more, many advertisers say they are willing to pay top dollar for the additional transparency they gain from content object signals—and the benefits of programmatic buying.

In fact, two-thirds of U.S. advertisers said content object signals would make them shift budget from linear TV to CTV/OTT video ads. It’s even higher among U.K. advertisers—78%.

Circle chart with the title “Majority of advertisers who would be willing to pay a premium to access Content Object signals via programmatic purchase would pay more than for a direct I/O deal, especially in the UK”. In the center “Willing to Pay Higher Price than Direct I/O to Access Content Object Signals Via Programmatic”. The US circle chart on the left has 71% of participants answering, “Yes”, 17% saying “No”, and 12% saying “Unsure”. On the left, the UK circle chart has 89% answering “Yes”, 3% saying “No”, and 8% saying “Unsure”. Significant differences between US and UK are that 17% of people in the US answered “No” and 89% of people in the UK answered “Yes”.

For more on content object signals and CTV transparency, see the full report.