The COVID-19 pandemic has up-ended all the norms of traditional TV ad buying, with the usual upfront ad sales season largely suspended.

That is what happens when brands, uncertain about their future prosperity, decide against making hefty upfront ad purchase commitments.

But, in their pursuit, instead, of agility and flexibility, could those brands be accelerating the adoption of programmatically-sold connected TV advertising? Growing murmurs in the industry seem to suggest so.

Earlier this week, Fox Networks Group also told us: “More and more advertisers want to find the exact household demographic that they’re looking for.”

Now, in this video interview with Beet.TV, Sean Robertson, partnerships director at DISH Media, says programmatic is giving pandemic-era advertisers the control they want.

From Commitment to Flexibility

“We saw a massive shift in upfront commitments,” he says. “And immediately there was the recognition that, while they weren’t looking for commitment … there was still product to sell. We knew that our partners needed to find audience and needed to have flexibility in placement.

“Walmart and some of the big box stores proved that there was still massive demand while people were staying at home and trying to shelter in place.

“So programmatic video proved to be a great outlet for those ad dollars to secure what would be upfront GRPs. And now that we’re coming out and the country is starting to reopen, I think folks that had been previously adverse to try an OTT products or shifting significant amounts of budget to premium OTT inventory have found that it operates just as well as your traditional video.

“It’s the same thing as television inventory, it’s just transacting in a different way.”

Programmatic ‘Windfall’

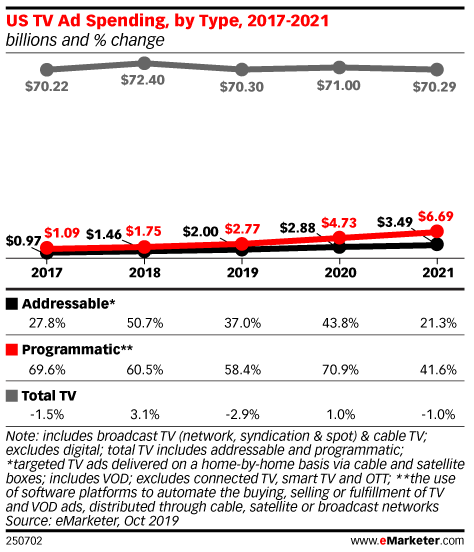

EMarketer in November estimated programmatic TV ad spending will reach $6.69 billion in the US by 2021, more than doubling from $2.77 billion.

That makes it a still-small but fast-growing part of the overall TV ad spending pie.

Ad buyers are getting interested by the ability to target specific audiences or households, the ability to use other data in doing so and the ability

Robertson says the pandemic is provoking an acceleration of the trend.

“It’s really opened us up to a new slew of advertisers and agency partners who may have tried working with us on a trial basis and some who were already committed, they just deepened that level of commitment,” he says. “It’s been a true windfall for us and for our partners.”

Tipping to Programmatic

Of course, DISH was already selling TV ads programmatically before the pandemic, including across Sling. In fact, Robertson says 60% of its transactions are now done that way.

The business still sells to agencies via traditional direct insertion orders (IOs), too.

It isn’t just about the transaction method. Connected TV technology allows DISH to offer its advertisers audience targeting and to attribute ad exposures to consumer outcomes.

“Being able to target them is one thing … but being able to actually prove the efficacy of a campaign (is another),” Robertson says. “We’re able to reach auto intenders. (Within) a 60 or 90 day window, we’re able to tell if somebody in that household (who viewed the ad) actually went to a dealership and/or if they actually transacted and bought a vehicle as a result of seeing the campaign.”

Partner Selection

So, how is it done? Robertson says DISH has chosen to work with “a small number” of demand-side and supply-side tech platforms after learning which partners they, in turn, work with.

“Frictionless” integration is the key, he says.

“These decisions are being made in real-time – execution in real-time and feedback in real-time are all part of that cycle,” Robertson adds.

“So that’s really where video has had to mature and evolve and really catch up to our digital partners in the marketplace. So the expectation is that you make your video inventory as digital as possible.”

This is from a Beet.TV series titled “The Accelerated Evolution of Programmatic OTT” presented by PubMatic.