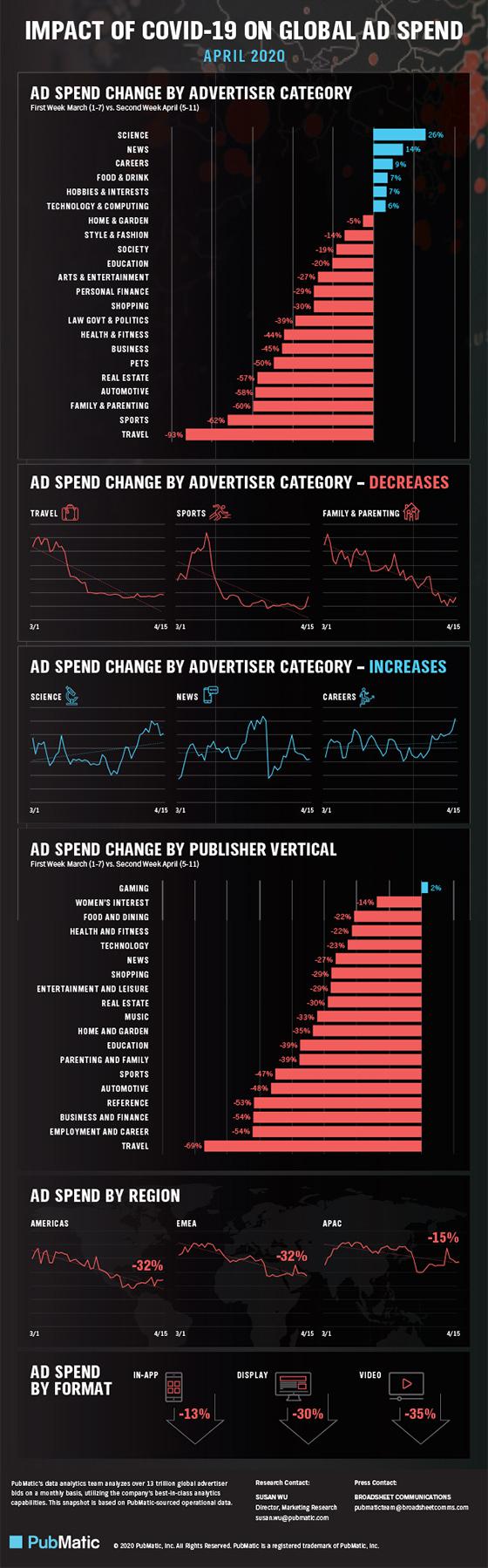

Data from PubMatic, a programmatic digital advertising technology company, shows how advertisers have changed their ad spending across key content categories, regions and media from March 1 through March 7 compared with the period from April 5 through April 11.

Spending on the Science category jumped 26%, while News rose 14%; Careers rose 9%; Food & Drink, 7%; Hobbies & Interest, 7%; and Technology & Computing, 6%.

Many more categories declined, and some performed better than others. Travel, the hardest hit, fell 93%. Sports followed falling 62%; Family & Parenting, 60%; Automotive, 58%; Real Estate, 57%; Pets, 50%; Business, 45%; Health & Fitness, 44%; and Law & Government, 39%.

Among those that took lesser hits, shopping saw a 30% decline, along with Personal Finance at 29%, Arts & Entertainment at 27%, along with Home & Garden at 14%, and Technology & Computing at 5%.

Among the nineteen publisher verticals analyzed, only Gaming saw an increase in ad spend at 2%. All other verticals experienced double-digit declines during the same time frame.

Spending on the Science category jumped 26%, while News rose 14%; Careers rose 9%; Food & Drink, 7%; Hobbies & Interest, 7%; and Technology & Computing, 6%.

Many more categories declined, and some performed better than others. Travel, the hardest hit, fell 93%. Sports followed falling 62%; Family & Parenting, 60%; Automotive, 58%; Real Estate, 57%; Pets, 50%; Business, 45%; Health & Fitness, 44%; and Law & Government, 39%.

Among those that took lesser hits, shopping saw a 30% decline, along with Personal Finance at 29%, Arts & Entertainment at 27%, along with Home & Garden at 14%, and Technology & Computing at 5%.

Among the nineteen publisher verticals analyzed, only Gaming saw an increase in ad spend at 2%. All other verticals experienced double-digit declines during the same time frame.

Travel took the biggest hit, falling by 69%, while Employment/Career fell by 54%, and Business & Finance fell by 54%.

Regionally, between March 1 and April 15, spending fell across the board. In the Americas, ad spending fell by 32%, while EMEA fell by 32% and APAC declined by 15%.

The ad formats also varied. In-app spending with the same time frame fell 13% and display declined by 30%. Video took the biggest hit, falling by 35%, although companies have said they are continuing to create more video content.

The data from PubMatic shows the damage across markets and continents.

Research from Integral Ad Science (IAS) shared by eMarketer shows that advertisers have begun to request that their ads not be served up near some COVID-19-related articles.

As brands return to advertising, 54% of U.S. marketers surveyed by IAS said ad content focused around travel should not serve up near COVID-19 content — and neither should content related to food and beverage or automotive. About 55% of respondents agreed that health and pharmaceutical ads would be acceptable.

Written by Laurie Sullivan, originally published in MediaPost