Programmatic omnichannel video (CTV and online video) ad spend grew 9% year-over-year, according to data from the PubMatic platform. This growth was driven in large part by a surge in paid impressions. However, a drop in CPMs offset this volume growth, resulting in lower overall omnichannel video revenue, as indicated in our Q2 earnings call.

The recent relative softness in video was not felt across all categories; similar to the retail industry, some advertising sectors experience seasonality while others tend to flow with macroeconomic conditions—and some are at the whims of both.

Seasonality

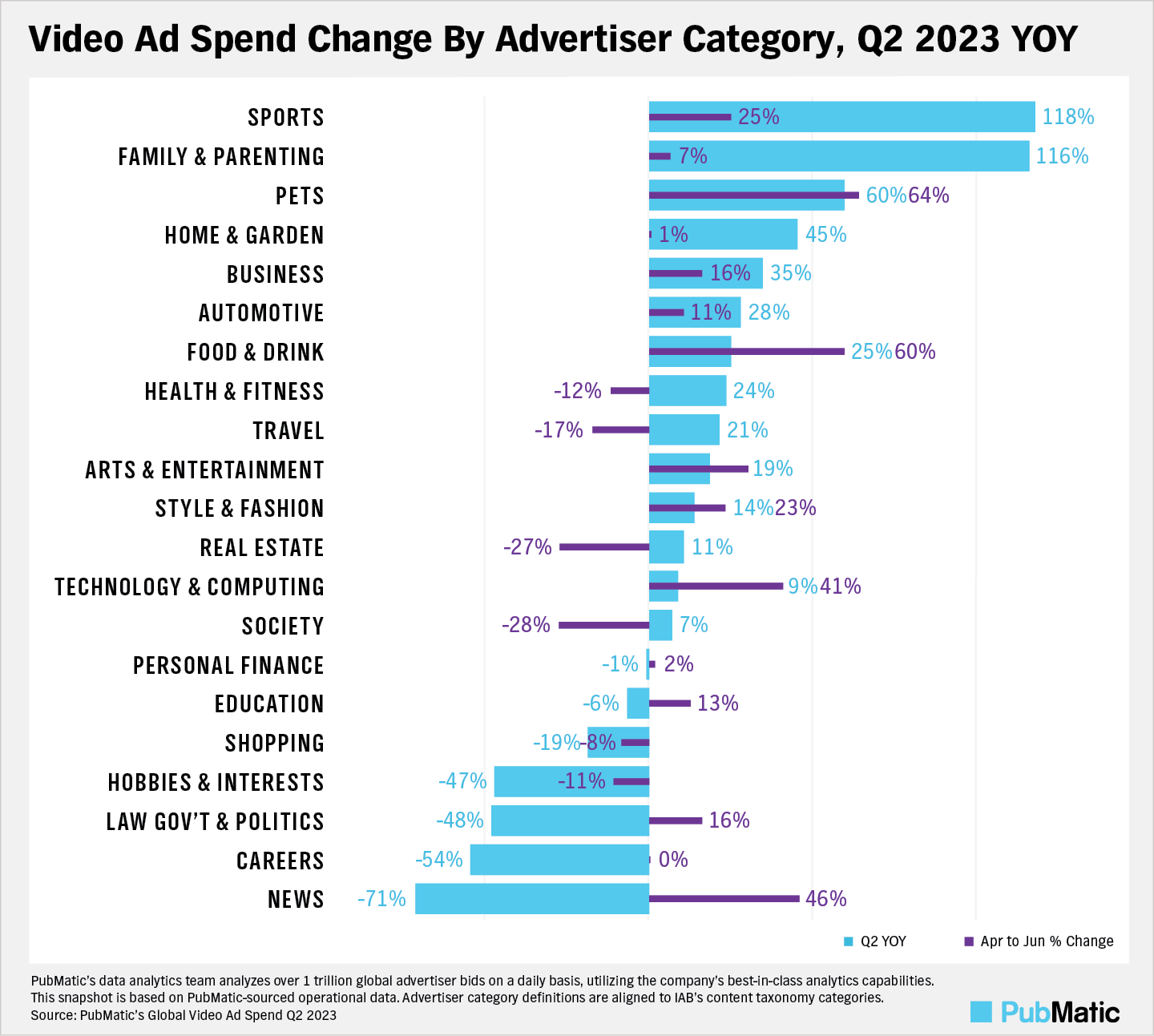

For example, PubMatic data shows ad spending in Sports grew 17% across all digital formats—and more than doubled in video in particular over the last year as sporting events like the Masters Tournament, Kentucky Derby and French Open picked up globally in Q2. Another typically seasonal category, Food and Drink, also saw rapid growth in Q2, including increases in spend in both display and video ad formats.

Macroeconomic and Environmental Impacts

As advertisers remain uncertain about the current economic environment, it is evident that buyers were tightly managing ad budgets towards the end of Q2. Data shows that several consumer ad categories were more sensitive to macroeconomic factors impacting discretionary spending: Shopping, Home & Garden, Society, and Sports saw a rise in overall ad spending between April and May, but then fell in June, where video was a core reason for the decline.

Meanwhile, the Pets category, along with Family and Parenting, saw the largest spend growth overall year-over-year, and third largest on video. In fact, Pets continued to grow despite high inflation and economic downturns, likely because of increased time spent at home and consumer desire for companionship.

What this Means for Publishers and Advertisers

It is important for all players in the programmatic supply chain to understand how both seasonality and macroeconomic trends impact ad revenue. Aside from large commercial shopping holidays, consumption behavior that is dependent on weather, school schedules and other activities can significantly influence advertiser actions. For publishers, this means having clear revenue expectations ahead of each upcoming quarter, having a diversified monetization strategy, and best positioning their inventory for the most relevant buyers. Meanwhile, insights into seasonal trends can help buyers plan and benchmark their campaign plans. In addition, knowing which formats are most effective can help advertisers devise better strategies to reach their target audiences. Both publishers and advertisers need to look at the broader picture of what categorical changes in ad spend means for their business, and consider when to shift campaign or monetization strategies throughout the year.

For more detailed programmatic ad trends, see our Q2 2023 digital ad spend and video ad spend reports.