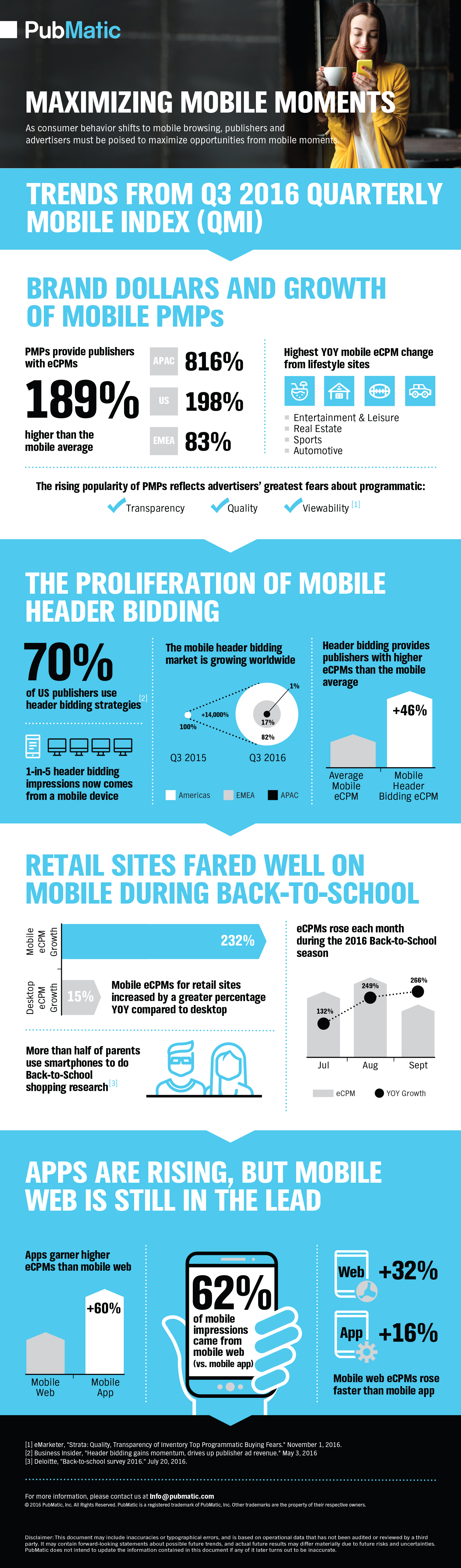

After analyzing the data behind the billions of impressions that flow through PubMatic’s SEVEN platform on a daily basis, we’ve seen four key trends emerge that demonstrate the power of programmatic for mobile advertising. PubMatic’s Q3 2016 Quarterly Mobile Index (QMI), released today, shows that publishers are seeing tremendous results in mobile performance and efficiency.

The two most significant findings from our Q3 2016 QMI boil down simply to ‘private marketplace’ and ‘header bidding.’ Basically, we’re seeing mobile rapidly adopt strategies and tactics for programmatic buying and selling at a faster pace than display has executed on.

Through our analysis we found that mobile private marketplace inventory is valued nearly 200 percent more than the mobile average. Given the benefits of mobile private marketplaces—specifically, the ability to serve ads in environments that provide transparency, help limit fraud and promote accountability—this growth demonstrates the continued shift of brand dollars to programmatic as brands become more comfortable with this channel. Going a step further and looking at the IAB publisher categories that saw the most growth in mobile web eCPM (Entertainment & Leisure, Real Estate, Sports & Automotive, etc.), it’s clear that publishers in the Lifestyle category should make premium mobile inventory available to buyers via PMP.

Our report also demonstrates that publishers around the globe are adopting header bidding strategies for their mobile web inventory as the result of the significant lift generated when all sales channels are able to compete at the impression level. While mobile web header bidding impressions were just emerging one year ago, PubMatic found that mobile web accounted for nearly one-in-five impressions transacted via header bidding in Q3 2016.

Header bidding impressions create more opportunities for advertisers to win an auction for the highly-coveted mobile consumer. Not only does this tactic generate higher eCPMs due to demand, but valuable cookie information gets passed that will allow buyers to make better decisions as well. Now that header bidding is table stakes for desktop and mobile web, the next frontier will include bringing header bidding beyond the header and into mobile apps. This will ultimately provide increased opportunities for growth.

Furthermore, during the Q3 Back-to-School season, retail publishers saw more than 230 percent increase in mobile web eCPM value. Shoppers are spending more of their time researching products and making purchased on their mobile devices, providing further opportunities for effective and engaging mobile advertising. This is particularly important heading into the retail-obsessed holiday season, during which publishers in the retail category should ensure that they are making their higher-quality mobile inventory accessible to advertisers targeting mobile consumers.

Although mobile app inventory share increased worldwide, mobile web monetization continued to provide the largest opportunity for premium publishers. PubMatic data shows that mobile web eCPMs grew twice as fast as mobile app eCPMs between Q3 2015 and Q3 2016, with a growth rate of 32 percent versus 16 percent for mobile apps. Advertisers and publishers need to balance mobile strategy to leverage the growing popularity of apps and monetization opportunity with mobile web. Partnering with programmatic experts can help achieve this goal.

We’ve summarized the key findings from our latest Quarterly Mobile Index in the infographic below, and you can download the full report by clicking here. Be sure to check back in a few months for our Q4 2016 Quarterly Mobile Index as well.