There are many themes in PubMatic’s customer discussions around the globe, but none more critical than innovation and helping our customers navigate between the hype and reality of the advertising technology sector. Every week, publishers are inundated with press releases, white papers and sales calls about why vendor X’s solution to problem Y is the silver bullet to their programmatic revenue strategy. As long term innovators in the programmatic advertising market, PubMatic has always taken a balanced and publisher-centric view of the challenges and opportunities, which has helped us earn a leading place globally among SSPs and exchanges for publishers.

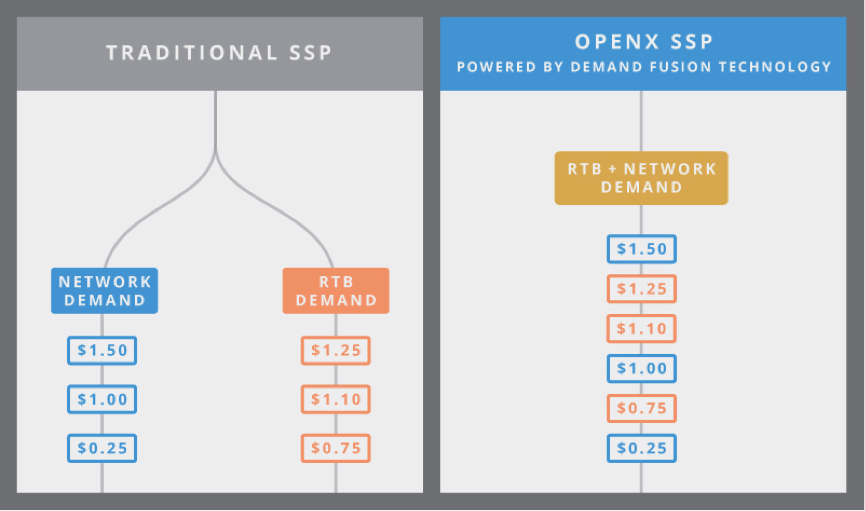

Take the announcement from OpenX yesterday. According to VentureBeat, “OpenX’s groundbreaking new approach represents a major advance over traditional SSPs by truly fusing Real-Time Bidding (RTB) and ad network demand into a single auction, driving up price by increasing competition and maximizing yield for publishers.” OpenX were kind enough to provide a visual explanation of how this works:

As a publisher, this sounds like incredible innovation. Apart from the fact that this technology is more than 4 years old.

So, OpenX, welcome to the party. The one we were having in 2010. Glad to see you are starting to catch up.

In fact, PubMatic launched this version of what we called our Unified Auction in 2010, predicting ad network pricing and combining with real-time pricing from RTB-based buyers to optimize yield for our publisher customers. See our 2010 whitepaper on the topic here (one of the industry’s first exclusively RTB-focused whitepapers).

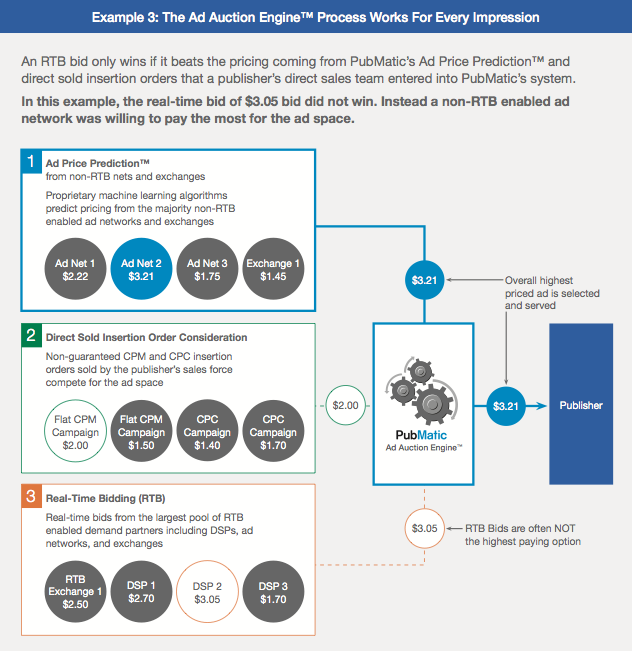

And over the last two years the market has moved on considerably. In 2010, ad networks were the dominant participants in the yield optimization equation, with RTB-based buying a smaller, but growing component. Fast-forward to 2014 and this dynamic has changed. RTB-based buying from DSPs and ATDs has accelerated and taken market share from the ad networks, reversing the market position of 2010. During this transition, our Unified Auction has calculated about 34 trillion bids on behalf of our publisher customers, with RTB-based buying performing on average at around a 200% improvement over ad networks.

More importantly, other buying models are now critical within our Unified Auction. Private Marketplaces have accelerated over the last 18 months to become a meaningful contribution to a publisher’s monetization strategy. For some publishers, PMPs contribute more than 35% of their programmatic revenue, up from 5% less than 12 months ago. And we now welcome the next buying model with the launch of PubMatic’s Automated Guaranteed, allowing a new set of buyers to participate within the Unified Auction, accessing inventory and audience on a guaranteed impression basis. Our question as we look at OpenX’s “groundbreaking new approach” is how do their publishers access this premium demand and maximize yield when this is absent from their auction?

Publishers are increasingly focused on the programmatic channel, but whilst Automated Guaranteed provides long-term increases in buying efficiency, publishers want to understand relative performance of direct and indirect channels. Launched in 2012, PubMatic’s Decision Manager integrates with a publisher’s ad server, allowing programmatic demand to compete with direct sold campaigns on a real-time basis. The publisher defines when indirect wins in order to ensure that their direct sold campaigns and delivery objectives are satisfied. What’s interesting of course is that when this truly dynamic management of demand is implemented, we of course see dramatic improvements in publisher eCPM across their inventory set, in the range of 30-50% over a period of several months.

To our current and future publisher customers operating their businesses in 2014, please continue to evaluate your technology vendors with care, as all innovation is not what it seems. Have a clear view of your business challenges and opportunities and ask your vendor to be very clear on how they are solving these for you. And if they can’t answer those questions, perhaps you’re speaking to the wrong team.